Digital Asset Treasuries (DATs) aren’t just about holding SOL.

The real game is putting their bags to work in DeFi, and staking via liquid staking tokens (LSTs) is the essential first step.

That’s exactly what’s happening with Sharps Technology, Inc. (NASDAQ: STSS), a medical device company that recently formed a DAT through a $400 million PIPE offering, using the proceeds to acquire over two million SOL. Through a new partnership with Solana cultural icon BONK, STSS is set to allocate a portion of its SOL to bonkSOL, BONK’s official LST that it launched in partnership with Sanctum.

In doing so, STSS is aligning with its commitment to supporting key ecosystem players while advancing its mandate to grow SOL per share.

https://x.com/stsssol/status/1967927396641935872

Why LSTs & DATs Are The Perfect Match

At Sanctum, we've long held the thesis that DATs accumulating SOL will inevitably turn to DeFi for yield, and LSTs like bonkSOL are the no-brainer entry point. They enable treasuries to earn staking rewards without locking up liquidity, thereby freeing up assets for rehypothecation across leading protocols.

Take our friends at Kamino, for example. The bonkSOL/SOL Multiply market delivers an additional 6.93% APY (median over the last 10 epochs) on bonkSOL holdings while maintaining full SOL price exposure.

And as far as DeFi ecosystems for STSS to kick off yield earning with, few are on par with BONK.

With over 400 integrations across dApps and protocols, BONK drives massive activity: BONKBot has clocked $14 billion in lifetime trading volume, while BONKfun generated $28 million in revenue this quarter alone. For STSS, holding bonkSOL opens doors to further yield opportunities while keeping liquidity circulating within BONK's vibrant network. It’s a win-win-win for STSS shareholders, BONK fanatics, and the broader Solana ecosystem.

For DATs, LSTs are more than a yield play. By diving into DeFi with bonkSOL, STSS is amplifying its brand among Solana's power users. Imagine STSS's treasury moves trending in BONK's community channels, or their allocation sparking collaborations with protocols that integrate bonkSOL. These possibilities, among many others, can infuse Web3 culture with institutional capital, turning what could’ve been a boring, static treasury into a visible, engaging force in the ecosystem.

We've seen similar dynamics with our other LST partners: deeper integrations lead to stronger adoption, more liquidity, and lasting community ties.

In the case of bonkSOL, holders earn BONK alongside staking rewards, creating a deflationary flywheel: BONK rewards draw users to bonkSOL, stake flows to the BONK validator, and validator returns reduce BONK supply. That design has already fueled stronger adoption of bonkSOL, which today has more than 200,000 SOL staked.

Start Earning Yield With bonkSOL

Over the past 30 days, bonkSOL has averaged a 6.84% APY across 15 epochs. It now sits at over 200,000 SOL staked from ~8,300 holders.

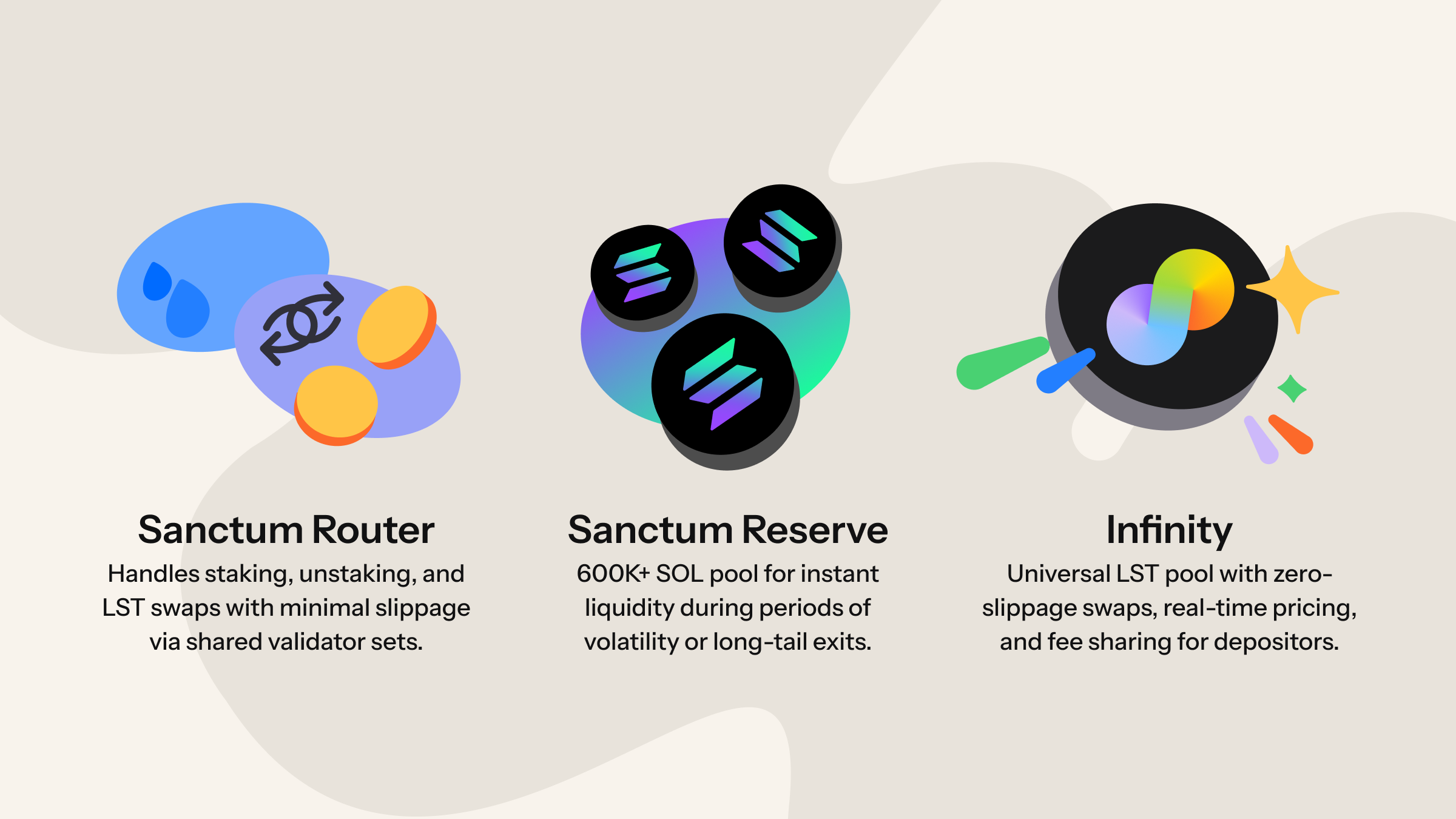

Behind the scenes, Sanctum’s liquidity infrastructure has already processed over 9.6 million SOL in swap volume and is backed by more than 400,000 SOL in active reserve liquidity, ensuring bonkSOL can be staked into or swapped out of with minimal slippage on venues like Jupiter.

That means DATs, whales, and everyday users don’t need to worry about liquidity bottlenecks. Large trades clear smoothly without the hidden costs (slippage penalties from shallow liquidity pools, failed swaps, or stalled redemptions) that have historically burdened many LSTs.

To get in on the action, visit our explore page and get bonkSOL:

→ app.sanctum.so/explore/bonkSOL

If you’re a DAT looking to maximize yield on your SOL holdings, discover how Sanctum can help your team launch a branded LST:

→ https://sanctum.so/blog/launch-branded-solana-lst-with-sanctum