Solana transaction counts are rising, new protocols are shipping, and institutional players are increasingly becoming involved in the network.

With that growth comes pressure for the entire ecosystem. And now, to continue ecosystem acceleration and have real-world financial institutions meaningfully operating at the base layer, Solana’s infrastructure needs to scale to meet the expectations of a global financial system.

To achieve this, transaction delivery is critical. Every app, wallet, and protocol on Solana depends on it. That’s why we built Gateway: to help teams land transactions reliably, even during the peak congestion periods that have scrambled users’ experience previously.

https://x.com/sanctumso/status/1947676833639514538

Gateway is part of a broader Sanctum product growth strategy stemming from our layer-based view of the Solana economy. In this model, value originates with users and flows downward from the apps, wallets, and protocols they interact with, to validators, and finally to stakers.

Solana’s 4-Tiered Value Flow

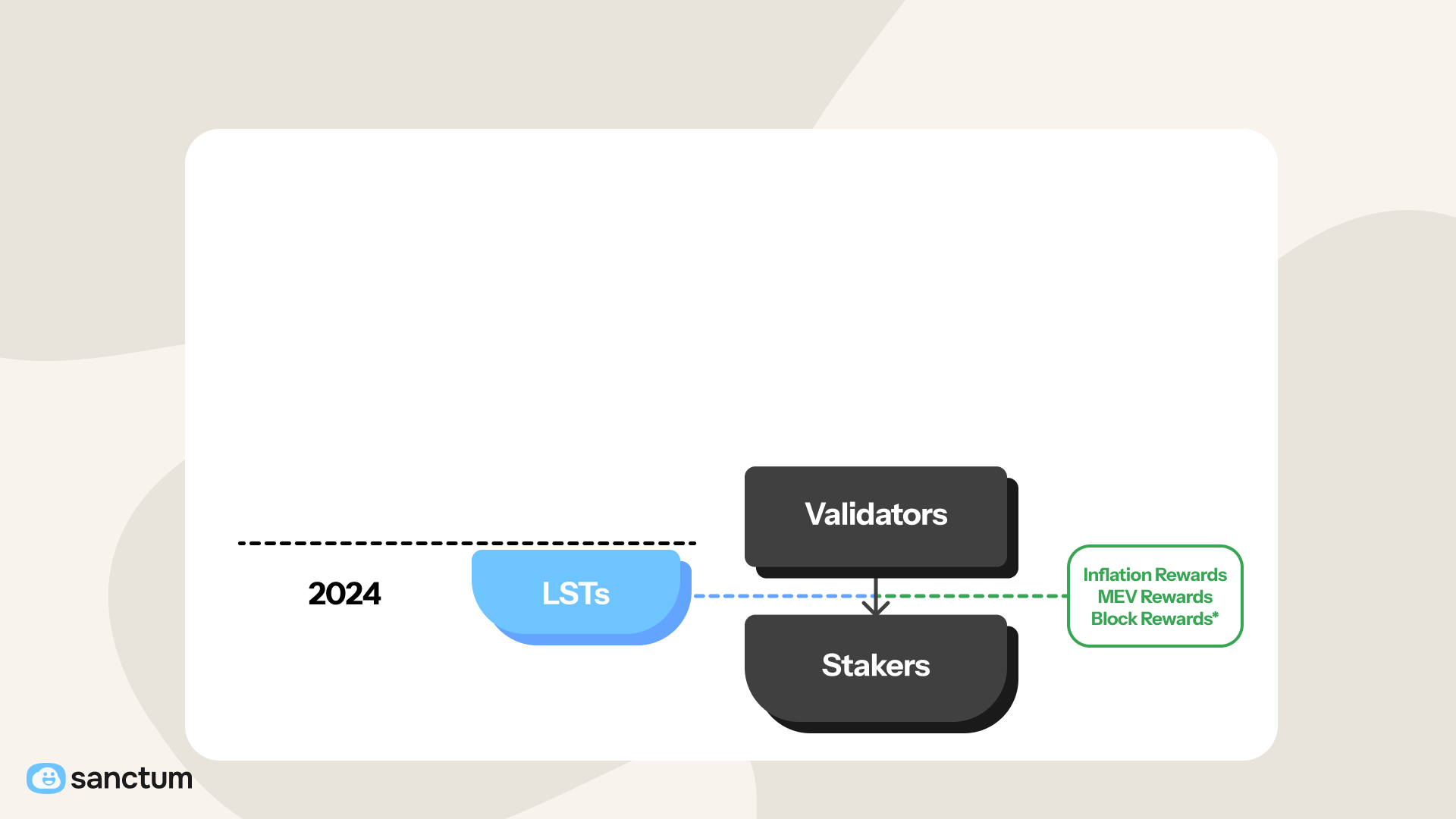

Sanctum’s history is rooted in the lower layers of the Solana economy between stakers and validators. This is where our flagship Liquid Staking-as-a-Service product and supporting LST infrastructure have helped partners launch branded LSTs, unlocking new revenue (earned when others liquid stake with them) while boosting capital efficiency for their users.

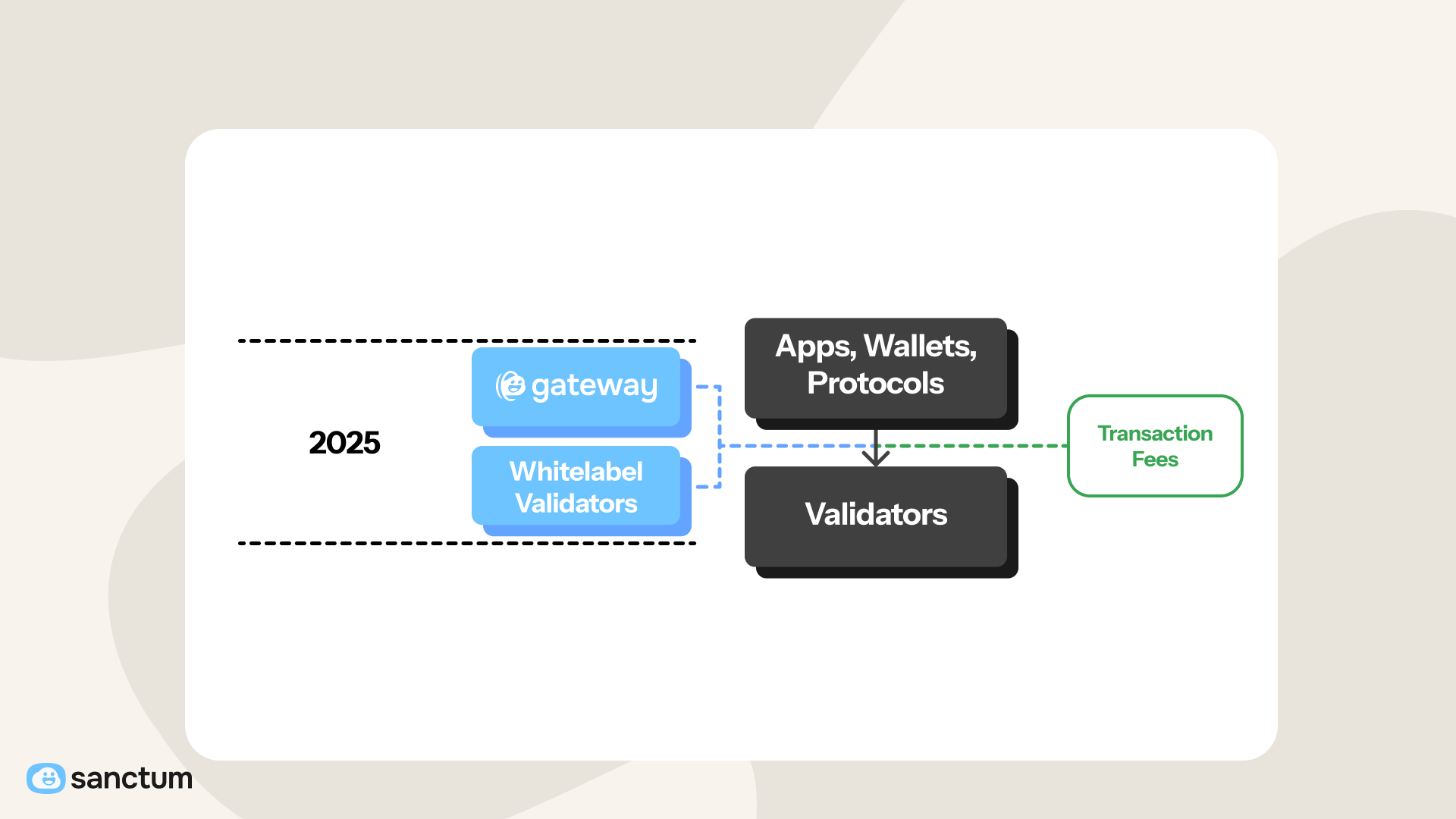

This year, to take Sanctum to the next level, we moved one layer up, building infrastructure that sits between validators and the applications, wallets, and protocols that serve users. This is the layer where performance issues quickly translate to product issues, and where the right infrastructure means the difference between a smooth user experience and frustration from slow or failed transactions.

Our strategy for this middle layer centers on two products: Gateway and Validator-as-a-Service. Gateway helps apps and protocols land transactions reliably and at scale. Validator-as-a-Service provides white-labeled validators that integrate seamlessly into partner products. Together, these products capture value from transaction fee volume. The more transactions that flow through them, the more value we create for partners by creating a better experience for their users, and the more value we capture at Sanctum.

Ultimately, our goal is to deliver value across all four layers of the Solana economy, building and maintaining products that make each layer more efficient, better connected, and more valuable to the one above it.

Now, at a deeper level, let’s explore how each layer functions, what participants’ needs are, and connect it back to where Sanctum fits into the equation.

Layer 4 - Users

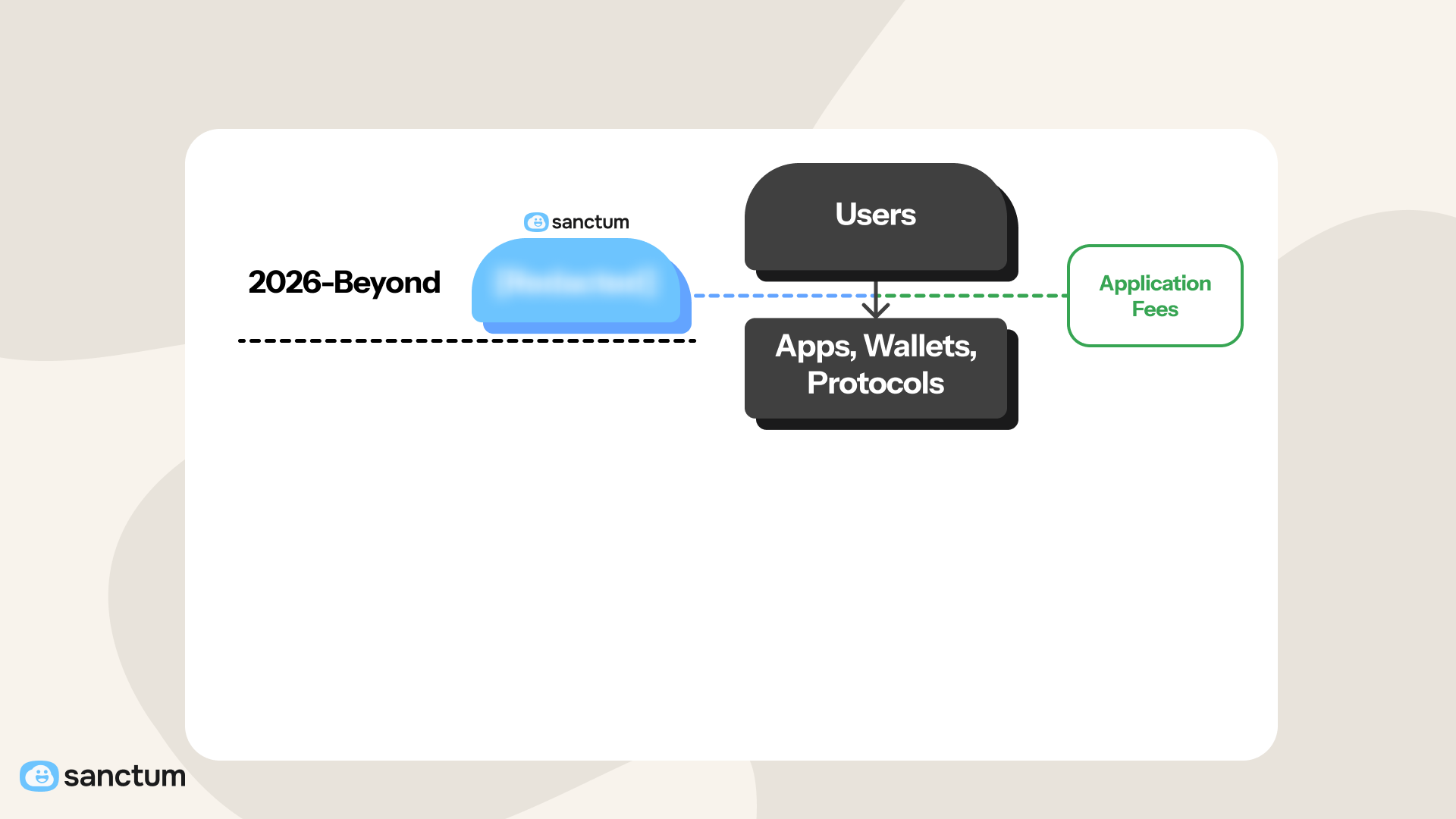

In any value chain, proximity to the end user typically captures the most value. Solana is no different; that layer is where the most value lives.

While capturing value directly from users offers the largest potential upside, it is also the most difficult to achieve. Users can be difficult to reach, quick to switch platforms, and resistant to change unless they see a clear, necessary benefit. Success at this layer requires delivering exceptional products and experiences.

Looking ahead to 2026 and beyond, this is where Sanctum will work to provide (and capture) value.

Layer 3 - Apps, Wallets, Protocols

End users at the top of the funnel are looking to swap tokens, lend or borrow assets, trade perpetuals, and perform countless other activities. Above all else, they care about outcomes: swaps that go through, yields that accrue, positions that correctly update, etc.

And to achieve those desired outcomes, users complete actions through applications, wallets, and protocols, paying fees along the way.

The infrastructure that supports these actions must be resilient, observable, and flexible enough to meet demand. Without that foundation, even the best-designed applications will fail to deliver consistent results. And if the chain’s best applications aren’t performing, users (and their value) will ultimately move elsewhere.

Put technically, to function, applications, wallets, and protocols must be able to reliably read from and write to the chain. If transactions do not land (complete their journey to block inclusion), services break down for the user.

Reliable validator access is, therefore, mission-critical for everything built on Solana, directly affecting product performance. With our Gateway product making transaction optimization and delivery easier than ever before, developers can maintain optimal product performance through smooth, predictable transaction processing.

This translates into better user experiences, higher retention, and stronger business outcomes for the apps, wallets, and protocols serving the users at the top of the stack.

Layer 2 - Validators

Every onchain action, from swapping tokens to minting NFTs, requires the application to send a transaction through a validator and pay for its inclusion in a block. To reach a validator (responsible for securing the network and producing new blocks), most transactions are first sent to an RPC endpoint, which then forwards transactions to the validator network.

The more stake validators attract from stakers, the greater their chance of being selected to validate transactions (and, in turn, earn rewards).

This incentive structure ensures that stakers are motivated to delegate their SOL to high-performing validators, creating a competitive environment that benefits the overall health and performance of the network.

Layer 1 - Stakers

To participate in block production, a validator must have enough SOL delegated to it. In Solana’s delegated Proof-of-Stake model, validators can attract this delegated stake by offering to share rewards with stakers. These rewards can include transaction fees, inflationary issuance, MEV revenue, and block rewards.

Positioned at the base of the Solana economy, stakers earn rewards by delegating SOL to validators. This is the layer where Sanctum has operated the longest, positioned between stakers and validators with our Liquid Staking-as-a-Service product.

Our primary focus in this layer has been on helping partners launch and grow their own LSTs, while we earn a share of the staking rewards in return. Over time, this infrastructure has become more robust, liquid, and reliable, enabling our partners to collectively earn more than $5 million from their LSTs, helping us capture a growing share of the network’s SOL.

Alongside delivering value to our partners, LSTs are immensely advantageous to stakers over traditional staking, providing a far more flexible system. With LSTs, stakers can maintain their stake liquidity for use in DeFi protocols, where they can deploy LSTs to earn additional yield. In exchange for the utility our LSTs provide, stakers are willing to share a portion of their rewards with us.

Why This Matters For Sanctum

To take Sanctum to new heights, we must build products that provide value higher and higher up the value chain. The next step up, which we’ve now taken with Gateway and Validator-as-a-service, is between validators and apps, wallets, and protocols.

The more layers of the Solana economy Sanctum touches, the more value we can capture, and the more revenue our business can generate, positioning Sanctum for long-term growth while compounding the benefits for our partners, users, and core community. That revenue becomes the engine for everything that follows at Sanctum: launching new products, expanding the scope of what we can deliver for CLOUD holders, growing our team, and accelerating the development of services that strengthen the entire ecosystem.

We’ve now arrived at the middle of the stack. Over time, we’ll work our way up.