On October 10, the crypto market saw a historic market selloff, with $19.5 billion in wiped-out positions marking the largest liquidation event in history. Within Solana’s ecosystem, onchain SOL liquidity tightened, and holders of LST Multiply positions noticed negative APY readings. The combination of falling prices, sudden liquidity demand for unstaked SOL, and reactive market behavior created short-term stress across the network.

During the volatility, Infinity (INF) provided unstaked SOL liquidity to ecosystem LSTs (much of which serviced demand from the Binance Staked SOL [bnSOL] depeg) and earned significant additional fees in return for INF holders.

Why Multiply Positions Turned Negative

A flash surge in demand for unstaked SOL over roughly 24 hours drove SOL borrow rates sharply higher. Multiply is essentially a leveraged position that assumes an LST’s yield will outpace the cost to borrow unstaked SOL. When borrowing costs rise suddenly, this spread can invert and result in temporary negative returns.

These conditions rarely last long. As users unwind loops and lenders move in to capture high yields, market forces typically bring rates back toward equilibrium.

What Drives INF’s APY And Why It Surged

INF’s yield comes from two sources: the weighted average yield of the LSTs it holds and additional fees earned from swap activity that routes through INF.

During volatile markets like October 10, when onchain SOL liquidity dries up, LST swap activity spikes as users rush to access unstaked SOL. A significant portion of that activity flows through INF, which earns substantial swap fees in return. These fees are reflected in future epochs, causing INF’s APY to rise sharply after periods of market stress.

This dynamic makes INF distinct from LSTs. While Multiply positions across the ecosystem turned negative when borrow rates surged during the crash, INF benefitted from the same conditions. Its liquidity-providing role caused yield to increase instead of decline in the epoch during the crash and in subsequent epochs. In other words, during times of network stress, INF’s performance is non-correlated with LSTs, making it the foundational asset for Multiply strategies.

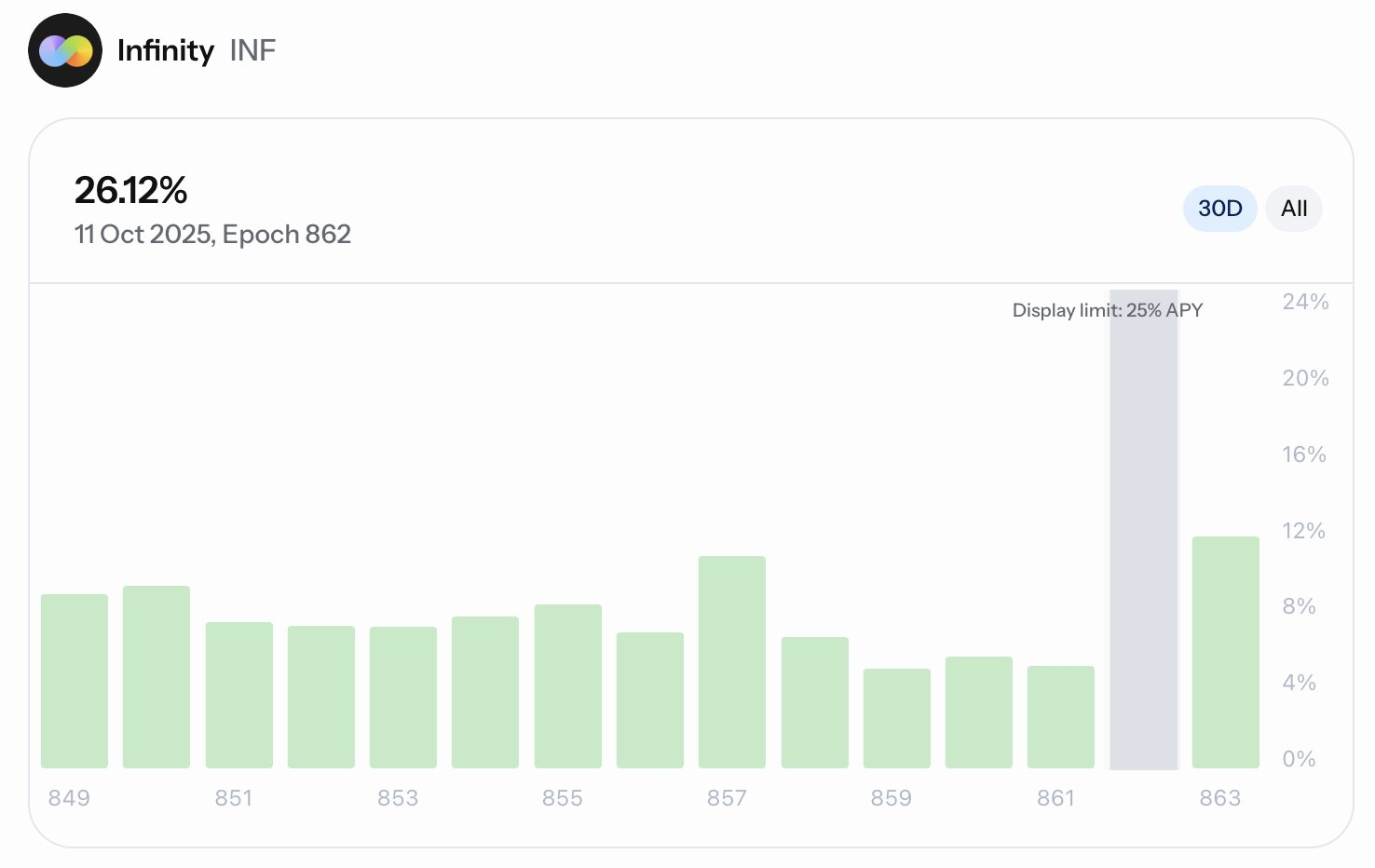

Because of this system, INF recorded an epoch return of 26.12% during the crash, which broke through the ceiling of our APY tracker’s display range.

→ Learn more about INF’s yield

INF Performing For Sanctum LST Partners

As liquidity thinned, some LSTs began to depeg, and all unstaked SOL within INF was depleted. We took emergency precautions to unstake nearly 300,000 SOL in INF to provide additional SOL liquidity to the market as needed.

However, this wasn’t enough. And so, in addition, we also reached out to the Jupiter Lend team and proposed increasing INF’s Multiply caps on their platform, and this increase was quickly implemented.

Soon after the cap increase, all newly available unstaked SOL was absorbed by the market, helping to restore balance for LSTs across the ecosystem.

As a result:

- More SOL entered INF to meet swap demand;

- The additional SOL liquidity immediately helped stabilize LST depegs;

- This earned additional fees for INF holders strengthening the Multiply loop LST.

Final Takeaway

The October 10th flash crash shone a spotlight on Infinity’s dual purpose: providing liquidity support to Solana LSTs and delivering exceptional yield to INF holders.

In times of market stress when demand for SOL and LST swaps spikes, INF’s true superpower is most visible, with the system providing significant outperformance for INF holders and much-needed liquidity to the entire Solana LST economy.