Sanctum Infinity (INF) continues to be the best place to grow SOL on Solana.

INF’s outperformance is derived from its liquidity provisioning for LST swaps, which involves Infinity servicing LST to LST, LST to SOL, and SOL to LST swaps for most LSTs on Solana.

→ How Infinity facilitates swaps

While Q4, 2025 got off to a strong start for INF, which makes most of its outsized APY from trading fees from LST swaps, network activity on Solana trended down toward the year-end, meaning yields trended down across the board for LSTs, including INF.

INF’s early success in Q4 can largely be attributed to three key factors:

- A successful launch and integration on Jupiter’s new borrow-lend product, Jupiter Lend, which included dedicated INF Multiply support on launch.

- Renewed focus and marketing efforts to improve the awareness and distribution of INF. This was supported by a change in team structure that appointed a team member to lead the growth and positioning of INF.

- INF performed non-correlated to the broader LST market on October 10th when the large flash crash occurred and provided hundreds of thousands of SOL of liquidity to the LST market during the BNSOL depeg and subsequent market fallout. INF recorded some of its highest APY epochs of the year during that week.

→ How INF performed during the October 10 crash

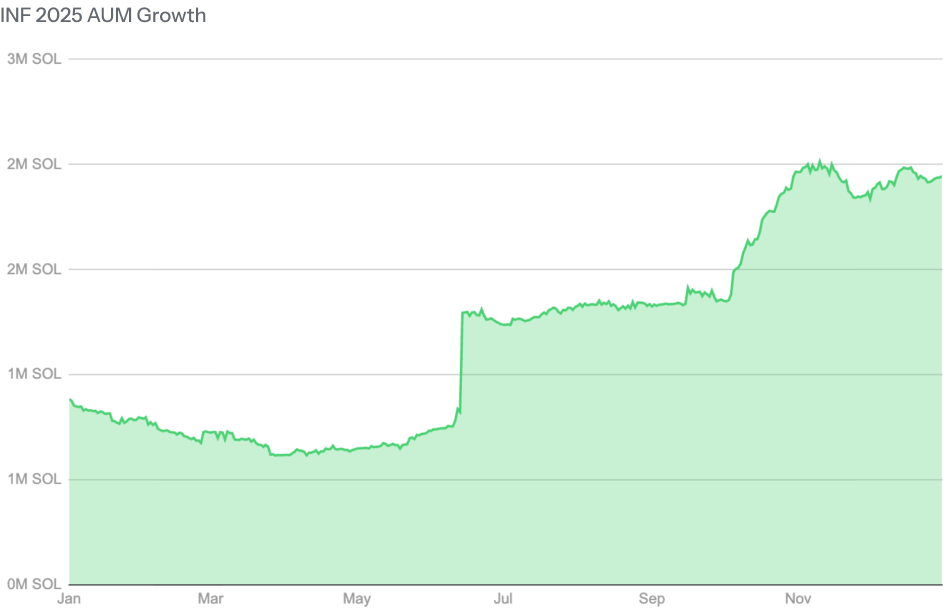

Ultimately, INF’s TVL (AUM) grew 47% in Q4 from 1.36 million SOL to 2 million SOL by Quarter end.

“2025 was a great year for both Sanctum and INF. At the mid-year mark, INF became a key strategic focus for Sanctum. I’m really pumped with the results of the team’s work. Despite market conditions quieting toward year-end, we made big improvements to the operational management of INF and came up with a healthy roadmap of upgrades that’ll make INF even better for LP’s and our partners. Excited for the year ahead.” - James Hanley

2025 Year in Review

With 2025 now complete, it’s worth stepping back to examine how INF performed across the full year, both in terms of asset growth and yield relative to the broader Solana LST market.

AUM

At the beginning of 2025, INF’s TVL (AUM) was 883,314 SOL. It finished the year at 2 million SOL.

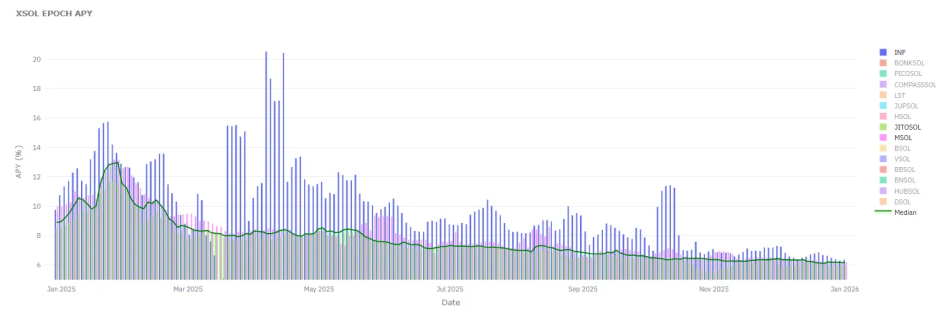

APY

In 2025, INF outperformed the LST Median (smoothed over 5 epochs) by approximately 20% on a relative basis. The following chart shows INF’s outperformance vs. the median Solana LST, JitoSOL, and mSOL as competitive benchmarks.

→ INF outperformed jitoSOL by 30%

→ INF outperformed mSOL by 21%

Notably, across the Solana network, a clear trend of LST yield compression is visible from early 2025 (when network activity was highest) through to year-end. In Q3, the network underwent two key upgrades, SIMD-207 and SIMD-256, that increased block size and reduced the competition for transaction inclusion. These changes lowered the need for MEV tips and priority fees, resulting in decreased LST yields on Solana that are reflected in Q3-Q4 data.

Despite this yield compression trend, INF averaged 9.62% APY across the entirety of 2025, solidifying it as the best LST on Solana.

What’s Coming In 2026

Looking ahead, we have some major upgrades to INF in the works, scheduled for release in early 2026.

This will further optimize INF’s SOL and LST liquidity provisioning to the market and improve the way in which yields are distributed for holders.

For additional context, you can read two of our previous blogs that outlined our endgame vision for INF: