Over the past year, Sanctum Infinity (INF) has proven to be the best place to grow SOL on Solana.

Well, that is without leverage and the risks that come with.

After the successful launch of INF on Jupiter Lend and integration into their Multiply product, many new eyeballs have mistakenly confused INF for just another normal LST, and it’s easy to understand why.

At a glance, INF resembles an LST; You put SOL in, it grows over time (APY), and you can swap it for more SOL in the future - just like an LST. However, while INF shares many traits with any other LST, it has one distinct difference, which is why it’s able to produce such high APY for its holders.

In this article, I’ll show you why.

What Is INF? A TL;DR

INF can be thought of as an LST of LSTs.

A changing basket of Solana LSTs on steroids. More specifically, INF is the token that represents percentage ownership of the managed basket of LSTs inside the Infinity LST pool.

INF derives its APY from the LSTs it holds. But the real juice is that it earns an additional layer of yield that no other Solana LST today can offer. This boosted yield comes from the trading fees INF enables.

That’s because INF is both a basket of Solana LSTs AND an LST liquidity pool. For more on how this liquidity pool works, read more here:

→ INF's Magic Sauce - The LST Lemonade Stand

But to explain this, and why INF has outperformed the largest LSTs on Solana by around 20% for the past year, let’s take a look under the hood of Solana LSTs.

So, What’s Behind A Solana LST?

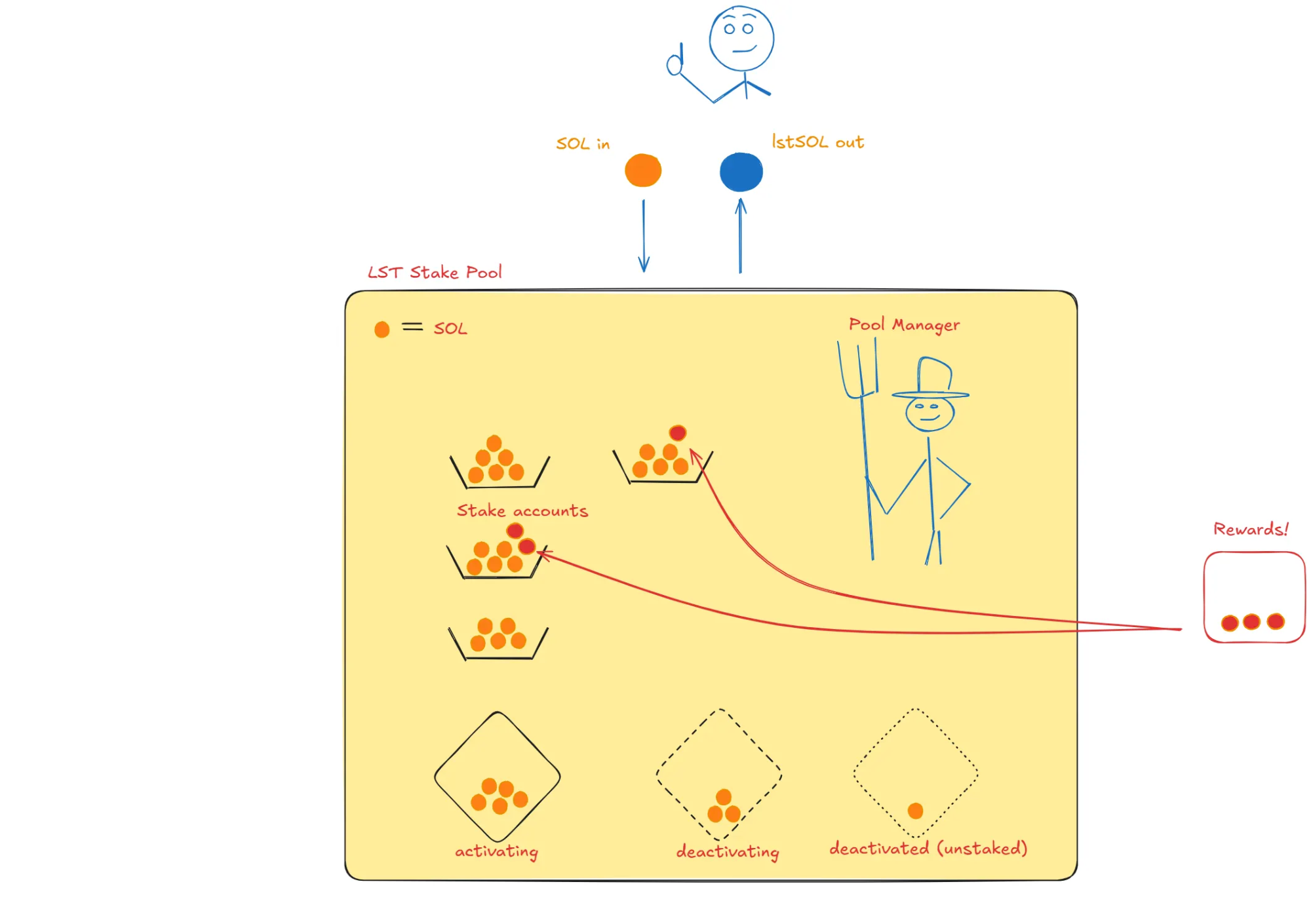

Behind every LST is the ‘Stake Pool’.

Inside this Stake Pool is where users’ staked SOL sits. This staked SOL is delegated to validators which are tasked with building blocks for the Solana network. The Stake Pool also has a Pool Manager whose job is to execute certain groundskeeping duties on behalf of the stake pool. Importantly, the Pool Manager’s duties are strictly defined and cannot withdraw the staked SOL from inside the pool.

The LST is the token that represents a piece of ownership of this stake pool. Anyone can deposit SOL into the stake pool to mint a piece of ownership for themselves.

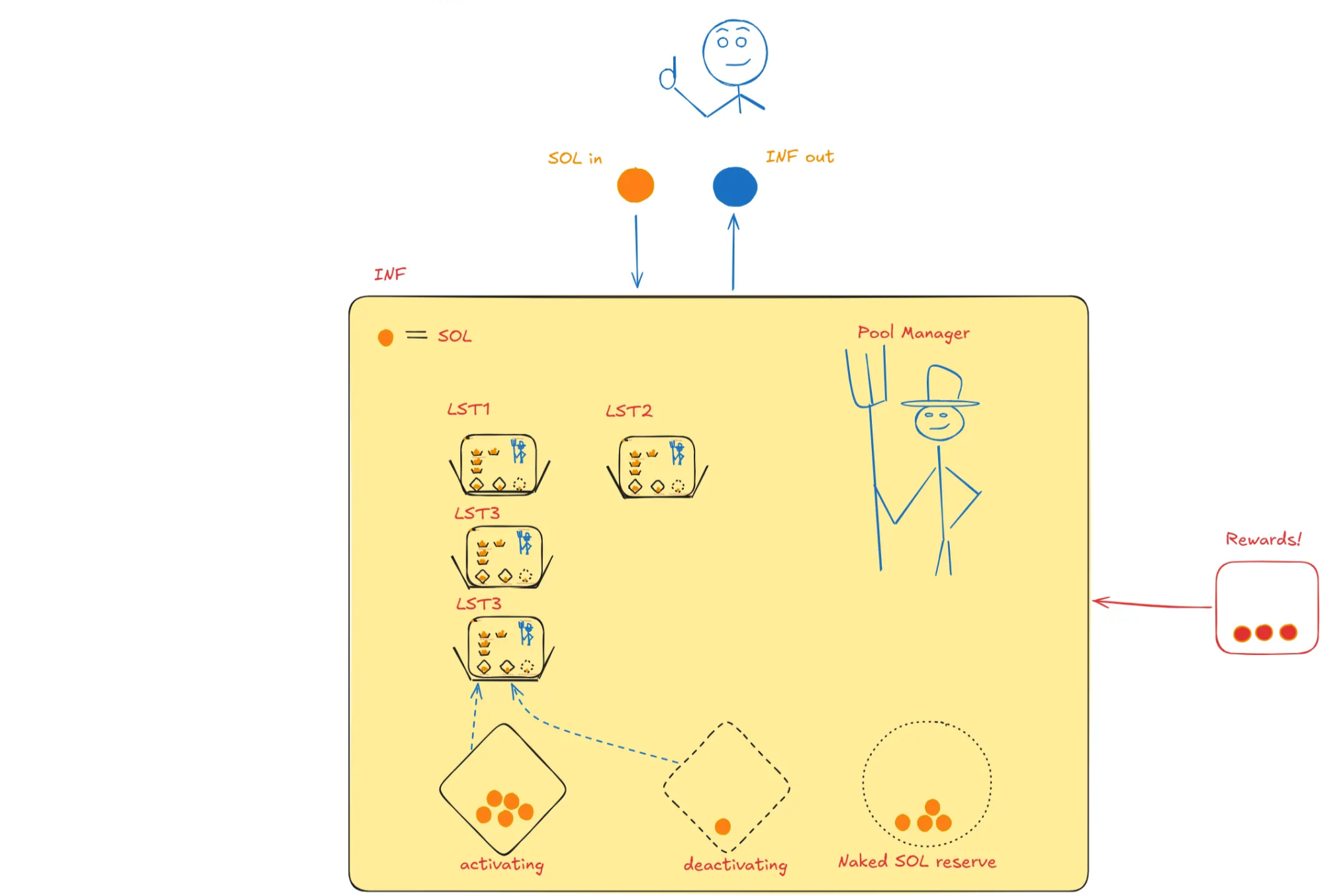

The image below visualizes the INF pool.

You can see how Infinity’s design looks almost identical to that of the LST, in that INF holds a bunch of staked SOL inside, has a pool manager and allows anyone to mint a new piece of ownership.

However, the two key differences for INF are that INF:

- Holds LSTs instead of just the stake accounts; and

- Acts as a Liquidity pool for the LSTs it holds, meaning anyone can swap LSTs with the Infinity pool.

As you can see, while INF looks like an LST, it’s actually more like an LST of LSTs. And what’s more, this unique design is what enables INF to earn APY above and beyond what a normal LST is able to earn.

Learn More

INF’s liquidity pool mechanism is incredibly important for Sanctum and its partners’ LSTs. To learn more about how INF plays that supporting role, read:

→ Our Vision For Infinity: SOL Liquidity For All Solana LSTs

→ October 10 Debrief: INF Stabilizes LST Depegs, Notches 26.12% Epoch Return