For Digital Asset Treasuries (DATs) managing significant SOL positions, the mandate is to protect capital, generate sustainable yield to increase SOL/share, and grow market share in an increasingly competitive environment.

We’ve built the infrastructure that enables exactly that.

As Solana’s largest full-stack staking protocol, with over $3 billion in total AUM, 1.3 million SOL staked through Infinity, and more than 1,400 LSTs launched, we support Solana’s biggest companies and investors through yield earning and launching custom-branded LSTs and validator architecture.

This experience has shaped our DAT Growth Playbook: three proven strategies to maximize returns on SOL holdings. Let’s dive in.

1. Simple & Safe: Hold Sanctum Infinity (INF)

For treasuries seeking a straightforward yield solution, Infinity is the most direct way to enhance yield without operational overhead. It’s the only liquid staking strategy that integrates trading fees in addition to the standard sources of yield.

- 10.5% historical APY (six-month average)

- $300M+ TVL and 44,000+ holders

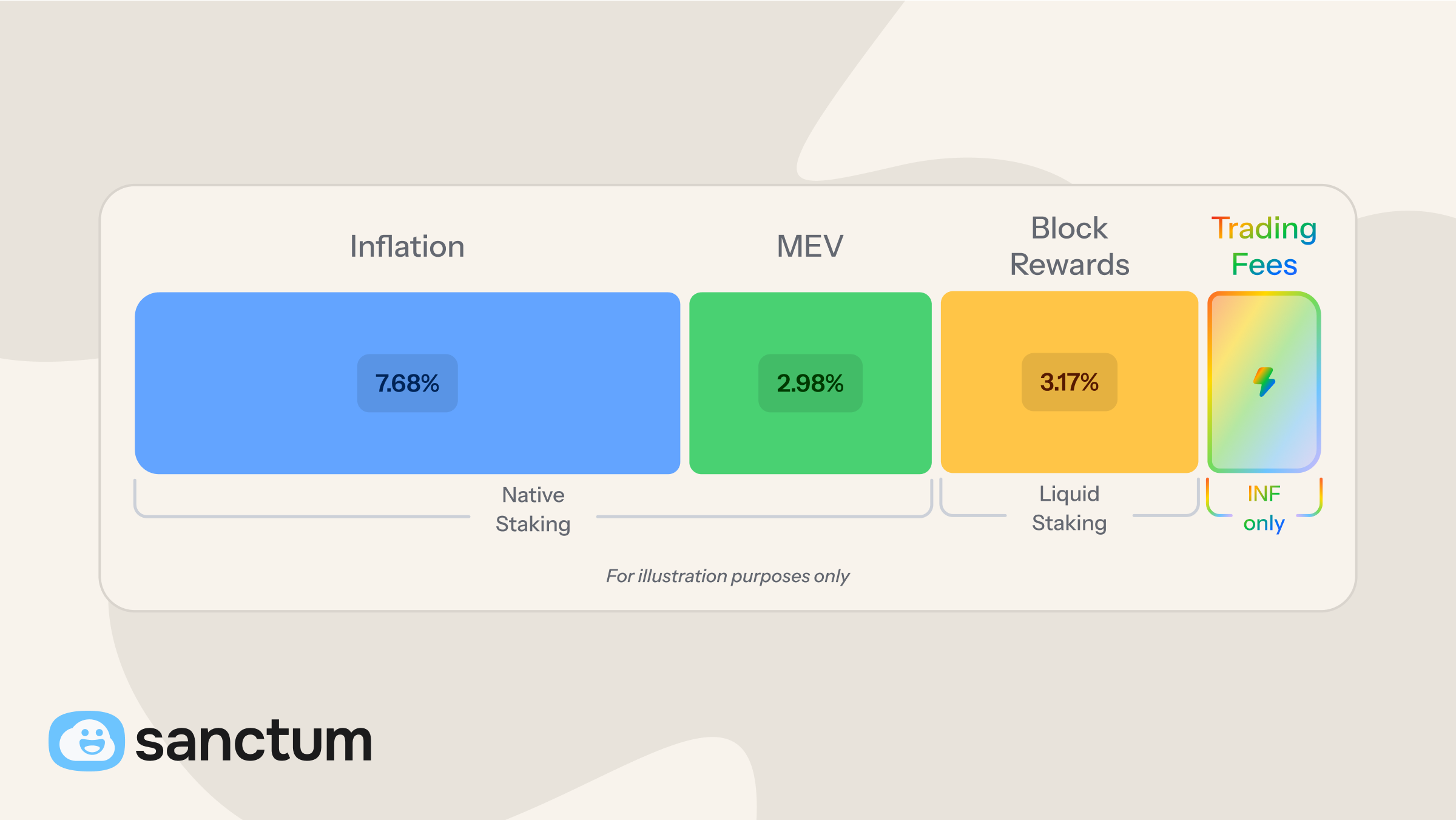

- Trading fees layered on top of staking yield, MEV, and block rewards

In Q2 2025, Infinity returned 15-20% higher APY than JitoSOL & mSOL with zero leverage, just LST APYs + trading fees, making it Solana’s leading SOL-yielding asset.

Whether compared against liquid staking tokens or native staking, INF consistently outpaces alternatives.

→ Sanctum's Infinity: The Ultimate Guide (2025)

2. Maximized Yield: Deploy INF in Solana DeFi

For any readers wondering if they could take Infinity and up the performance, the answer is yes.

When a user stakes SOL to participate in earning yield with Infinity, they receive INF: a freely-transferable tokenized receipt of their stake. INF is already embedded in Solana’s most advanced money markets, where it can be looped to compound returns.

Important note: Looping introduces DeFi-specific risks tied to third-party platforms. Treasuries using this strategy should consider and implement risk management and oversight best practices.

By borrowing against INF, restaking, and repeating, DATs can achieve upwards of 27% APY, depending on prevailing rates and liquidity conditions.

→ INF on JupLend (coming soon)

3. Full-Stack Staking: Build with Branded LSTs + Sanctum Validator

For treasuries with long-term ambitions, the most powerful approach is Staking-as-a-Service, our full-stack staking solution that plugs DATs into each infrastructure-based layer of the Solana economy.

We achieve this through a triple-threat tailored approach designed to maximize SOL yield without imposing engineering overhead on participating teams:

Branded LSTs

Launching a branded LST is one of the most effective ways for DATs to secure long-term distribution and turn staking into a revenue engine. With Sanctum, your team can extend its brand directly into the Solana economy, creating a first-class product that earns yield, attracts stake, and compounds visibility across DeFi.

Our turnkey infrastructure removes the barriers that make LSTs difficult to launch independently. We manage liquidity, operations, and day-one DeFi integrations, enabling your LST to scale seamlessly while generating sustainable returns. Our partners have already earned millions in additional revenue through this model, without shouldering the cost and complexity themselves.

→ Launching A Branded Solana LST: Sanctum’s Turnkey Solution

White-Label Validator

A white-label validator gives DATs a direct line into the most comprehensive yield streams available on Solana. In addition to capturing inflation rewards, MEV, block rewards, and transaction fees—with ~80% of priority fees returned to stakers—our validator offering removes the technical complexity of running one yourself.

We handle setup, ongoing maintenance, security, and optimization, ensuring your validator runs smoothly while you maintain full control. As adoption of your branded LST grows, your validator becomes a natural extension of your treasury strategy, helping attract stake, tap into Solana’s delegation programs, and build a durable inflow pipeline.

For institutions, this approach means compounding yield across every layer of the network without engineering overhead, while preserving flexibility to scale, customize delegation strategies, and expand distribution as your DAT grows.

→ Learn more about launching a white-label validator

Infinity (INF) Secure additional returns by depositing freshly-earned SOL into Solana’s leading SOL-yielding asset.

→ Why Is Infinity the Best Strategy to Stake Solana?

Next Steps for Solana Digital Asset Treasuries

At Sanctum, we’re committed to helping treasuries turn SOL holdings into lasting growth. The sooner DATs activate these strategies, the stronger their position will be in Solana’s evolving economy.

For treasuries committed to building lasting inflows and deep industry influence, Sanctum is the foundational first step.